Cheque Truncation System (CTS) is a cheque clearing system undertaken by the Reserve Bank of India (RBI) for quicker cheque clearance. As the term proposes, truncation is the course of discontinuing the flow of the physical cheque in its way of clearing. Instead of this an electronic image of the cheque is transferred with vital essential data.

Cheque Truncation System brings elegance to the whole activity of cheque processing & clearing and offers numerous benefits to banks like time and cost savings, cost effectiveness, including human resource rationalization, business process re-engineering and enhanced customer service.

• Time, money and manpower expended on physical transfer of cheques from banks to clearing house are eliminated

• Clearing related frauds become less plausible

• Probability of cheques misplaced in transit is eliminated

• CTS is more advanced and more secure.

• It provides quicker clearance of cheques

• Reduces operational risk and risks related to paper clearing

• There are no extra charges levied for the collection of cheques drawn on a bank located within the grid, further providing no geographical restrictions

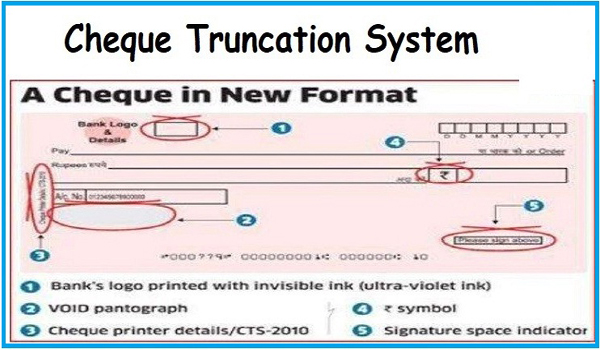

• All CTS cheques hold a watermark, with ‘CTS-INDIA’, which is visible when held against any light source

• Pantograph (wavelike design) with hidden / embedded word ‘VOID’ become clearly visible in photocopies of a cheque